JUPITER SEA & AIR SERVICES PVT. LTD, EGMORE – CHENNAI, INDIA.

E-MAIL : Robert.sands@jupiterseaair.co.in Mobile : +91

98407 85202

Corporate News

Letter for Wednesday November 30, 2022.

Today’s Forex Rates : Source –

The Economic Times

|

CURRENCY |

PRICE |

CHANGE |

%CHANGE |

OPEN |

PREV.CLOSE |

DAY's LOW-HIGH |

|

81.69 |

-0.009995 |

-0.012233 |

81.72 |

81.70 |

81.6825- 81.775 |

|

|

1.0261 |

-0.0064 |

-0.619854 |

1.0319 |

1.0325 |

1.024- 1.0268 |

|

|

96.7104 |

-0.7313 |

-0.7505 |

96.9566 |

97.4417 |

96.5947- 97.0375 |

|

|

83.918 |

-0.8937 |

-1.053746 |

84.2792 |

84.8117 |

83.8345- 84.3443 |

|

|

141.753 |

1.383011 |

0.985261 |

140.25 |

140.37 |

141.633- 142.243 |

|

|

1.1858 |

-0.0032 |

-0.269138 |

1.1907 |

1.189 |

1.1816- 1.1864 |

|

|

107.514 |

0.584 |

0.546151 |

106.968 |

106.93 |

106.894- 107.60 |

|

|

0.5797 |

-0.0037 |

-0.634216 |

0.5831 |

0.5834 |

0.5796- 0.5835 |

:: Sea Cargo News ::

Assets of 9 major ports being considered for monetisation:

Minister

Union minister Shantanu Thakur today said that assets spread across nine major ports have been considered for monetisation between FY22-25 under the National Monetisation Programme, according to a FICCI (Federation of Indian Chambers of Commerce) release.

The Minister of State for Ports,

Shipping and Waterways while highlighting goals of the ministry added that PM

(Prime Minister) Gati Shakti National Master Plan will lead to huge benefits

for state governments.

He also said that Kolkata, which

hosts the country's oldest port, has a pivotal role to play in realising the

goal.. Additionally, 11 industrial corridors and two defence industrial

corridors are planned for development to improve the operational efficiency and

capacity utilisation of existing port assets.

Addressing the PM Gati Shakti

Multimodal Maritime Summit 2022 in Kolkata, he said the Ministry of Ports has

the most critical role in Gati Shakti National Master Plan. The PM Gati Shakti

plan, a ₹ 100 lakh-crore project for developing 'holistic infrastructure', was

unveiled in the last budget by Finance Minister Nirmala Sitharaman.

CBIC not to file review petition in SC for restoring IGST

on ocean freight

The Central Board of Indirect Taxes and Customs (CBIC) has decided not to file a review petition in the Supreme Court against the latter's decision to quash integrated goods and services tax (IGST) on ocean freight.

The Board gave this information

through its communication to the field formation. Ocean freight is the cost

incurred through an agreement between two foreign parties to ship goods to

India. For instance, if goods are exported from Washington, the exporter

concerned may enter into an agreement with a shipping line there and pay ocean

freight to it.

A provision in the Central GST

Act permitted levy of both basic customs duty and IGST on the cost, insurance

and freight (CIF) value of goods brought into India. A government notification

later also extended IGST to ocean freight on importers on the reverse charge

mechanism.

Under GST, service tax is

usually paid by sellers of services, but where it becomes difficult for the

government to receive tax from sellers, it imposes it on recipients of services.

This is called the reverse charge mechanism. The matter went to the Gujarat

High Court which had declared IGST on ocean freight as violative of the

Constitution.

The Union government moved the

Supreme Court against the Order. The Apex Court also struck down the levy,

saying it is in the violation of the “principle of supply” enshrined in CGST

Act.

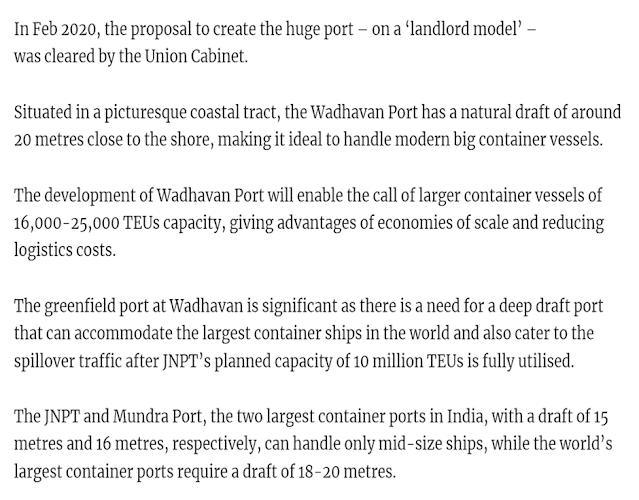

Activists Protest Against Construction Of Rs 65,000 Crore

Mega Port At Wadhavan Near Mumbai

After the protests against the

construction of Vizhinjam international sea port in Kerala, another proposed

mega port came under the fire of protestors.

This time the planned mega

container port at Wadhavan, near Dahanu in Palghar district of Maharashtra, is

being opposed by activists. On Monday (21 November), protestors from seven

local organisations gathered at Azad Maidan in Mumbai demanding the rollback of

Rs 65,545 crore port development project.

“The proposed port will thus

lead to the collapse of an entire self-sustaining economy in the region,

thereby displacing a huge number of fishermen, small-scale industries, farmers

and adivasis,” the Wadhavan Bunder Virodhi Sangarsh Samiti, which is spearheading

these protests, said in a statement.

The Wadhavan Port will be

located at a distance of 140 km from Mumbai and 150 km from Jawaharlal Nehru

Port Trust (JNPT). Upon completion, the port will catapult India among

countries with the top 10 container ports in the world. Jawaharlal Nehru Port

Trust (JNPT) and Maharashtra Maritime Board will execute the project jointly.

Kerala halts exports of vegetables, fruits indefinitely

The All Kerala Vegetable and Fruits Exporters Association has decided to stop export of vegetables and fruits from Kerala from November 25.

The

decision has been taken in view of the unaffordable freight charges and the

Union government’s decision to impose GST on exports. The government had issued

an order imposing 18% GST on air freight and 5% GST on ocean freight from

October 1.

Though

the Kerala Exporters Forum had submitted memorandum to Union Finance Minister

Nirmala Sitharaman and Commerce Minister Piyush Goyal seeking to remove the GST

on exports, no decision has been taken in this regard, said secretary Munshid

Ali.

For the

first time in two years, export from India had recorded a 16.6% decline in

October. The exporters said they are unable to compete with products from Sri

Lanka, Pakistan and Bangladesh due to high freight charges and GST. Many

exporters are forced to cancel orders as it is not viable to export vegetables

due to the high charges, said forum president V K C Hameed Ali.

Ongoing protests may delay completion of Adani port in

Vizhinjam

The Kerala government’s ambitious Rs 7,500 crore Vizhinjam Seaport, being developed by the Adani group in the southernmost part of the state, has been facing deadlock due to the over 100-day protest by the locals led by the leadership of the Latin Catholic Archdiocese here.

Keen to

finish the project as early as possible, the state government has appealed to

the church authorities to end the protest as it was crucial for bringing

changes to the industrial and economic sector of the country.

The

government claimed it has accepted almost all demands of the protesters.

However, the protesters are not ready to budge, alleging the project will

adversely affect the livelihood of the fishermen, coastal eco-system and the

ecology of the Western Ghats due to mining of granite stones for the same.

The

agitators also alleged the government has not given any written assurances on

their demands even after many minister-level discussions. The Vizhinjam

International Transhipment Deepwater Multipurpose Seaport is being developed in

a landlord model with a Public Private Partnership component on a design,

build, finance, operate and transfer (“DBFOT”) basis at an estimated cost of Rs

7,525 crore.

Demand forIndian sugar in the international market, mills

are racing to ink agreements for exports

With a high demand for Indian sugar in the international market, mills are racing to ink agreements for exports. Rahil Shaikh, vice-president of the All India Sugar Traders Association, talked about the agreements with various mills for the export of a total of 60 lakh tonne of sugar which would be completed by December while the physical deliveries to be executed by March-end.

After

last year’s record 112 lakh tonne of exports, Indian millers talked about

another year of good overseas sales. The central government had issued a

mill-wise quota for exports with a total 60 lakh tonne of sugar expected to be

shipped out in the first tranche.

The

industry hopes that the government would allow exports of 20 lakh tonne of

further exports once the first lot is exported out. Shaikh, who is also the

managing director of MEIR commodities, an export-import firm, said they have

seen good demand from countries like China, Bangladesh and countries in the

Horn of Africa.

At

present, the international markets have breached the psychological mark of 20

cents per pound of raw sugar which has also helped the mills to make up their

minds.

India’s exports could slow amid global recession,

uncertainties: Piyush Goyal

India’s

outbound shipments could slow amid the global recession and uncertainties,

Commerce and Industry Minister Piyush Goyal said on November 24. In October,

the country’s exports declined sharply 17 percent, the first shrinkage in

nearly two years.

The

trade deficit widened sharply. India’s current account deficit will beach the

red line of 3 percent of gross domestic product this fiscal year, primarily

because of the trade gap. India’s trade deficit has ballooned in recent months

amid elevated commodity prices and a recovering domestic economy which has

boosted imports.

Meanwhile,

a slowing global economy has pressured outbound shipments. The widening of the

trade deficit is due to the rise in oil imports amid high crude oil prices,

said Goyal, who was speaking at Times Now Summit.

The

country is on the path of rapid recovery. India is seen a global bright spot

and is evincing interest from companies that is seeking to shift away from

China, the minister said.While the trade deficit has widened, the trajectory is

under control, he added. Capacity utilization of over 80 percent in most

industries is a sign of upcoming investments, Goyal said.

CMA CGM containership sets record as Miami’s largest to

sate

PortMiami,

while best known as the cruise capital of the world, is also continuing to

enhance its cargo operations. Last week, on November 17, the CMA CGM Osiris

(156,000 dwt) became the largest containership to ever arrive in the port.

According to Miami-Dade’s mayor, it is part of a trend that will continue to

see larger vessels docking in the port after efforts to upgrade the facilities.

“I am so

proud of PortMiami, and what it has accomplished following years of

infrastructure investments made by Miami-Dade County,” said Miami-Dade County

Mayor Daniella Levine Cava.

“As an

alternative to West Coast traffic, PortMiami offers shippers the advantage of

open express access to deep-water docks, super post-Panamax electric cranes, a

port tunnel with direct highway access, and a national freight rail connection

reaching most of the U.S. within four days, in addition to its daily link to

Latin America and the Caribbean.”

The

containership, which is just a year old having been built in China, is the

first of a new class of vessels expected to regularly call at PortMiami. The

CMA CGM Osiris is a 1,200-foot containership with a capacity of 15,536 teu.

King Fahad Shipyard in Dammam receives mega container for

repair

The

Saudi Ports Authority (Mawani) has said the King Fahad Shipyard, King Abdulaziz

Port’s in-house vessel repair facility, received mega container MSC ALIZEE III,

the largest ever in its history, to undergo necessary maintenance and

modification.

Thanks

to its supreme operating capabilities and the 360-degree modernization of its

infrastructure, King Abdulaziz Port in Dammam counts itself amongst the world’s

best in productivity, regulatory efficiency, and digital transformation as

envisaged by Mawani’s pathbreaking Smart Ports initiative and the objectives of

the National Transport and Logistics Strategy (NTLS) to position Saudi Arabia

at the forefront of the global logistics industry.

Owned by

the Mediterranean Shipping Company (MSC), a global logistics giant, the MSC

ALIZEE III spans a length of 208.3 meters and a width of 30 meters with its

draft measuring 7.4 meters deep. Set up in 1982, the state-of-the-art King

Fahad Shipyard received the bulk carrier African Jacana in November 2021, which

had a carrying capacity of 17,000 tons and a length of 200 meters.

::// AIR

CARGO NEWS //::

Vistara to merge with Air India, confirms Singapore Airlines

Singapore Airlines Ltd (SIA) on Tuesday confirmed the Vistara-Air India

merger in a press release.

SIA will invest nearly $250 million into Air

India as part of the transaction, the Singaporean carrier said in a statement,

with the pair aiming to complete the merger by March 2024 subject to regulatory

approvals.

SIA could spend up to $615 million based on its

25.1% post-completion stake, payable after the completion of the merger, it

said, adding it would fund the growth plans through its internal cash

resources.

Tata group currently owns a 51 per cent stake in Vistara, and the

remaining 49 per cent shareholding is with Singapore Airlines (SIA). The agreement will create a stronger rival to

the country's dominant carrier IndiGo and give the Singaporean airline, which

lacks a domestic flying market, a more solid foothold in one of the world's

fastest-growing aviation markets.

It will also allow the Indian conglomerate to

consolidate its brands around full-service Air India and low-cost Air

India Express, which is being merged with AirAsia India after Tata bought out

former partner AirAsia.

In a statement, Vistara CEO Vinod Kannan said

that Vistara is a fine manifestation of its parent brands Tata Sons and

Singapore Airlines, and "we are delighted that we will continue to be

guided by their legacies as we merge with Air India".

"The integration process will take some

time, and during this phase, it will be business as usual for all our

stakeholders, including customers. We will continue to share relevant

information with all of them, as appropriate," he added.

A full-service carrier, Vistara was the

country's second-largest domestic carrier with a market share of 9.2 per cent

in October.

"There is enormous potential for an airline

group with the scale and network of the combined entity. We look forward to

providing more opportunities for our customers, employees, and partners while

putting a spotlight on Indian aviation on the global stage," Kannan said.

The October 2021 sale of Air India to Tata Sons

ended decades of attempts to offload the carrier from the government’s books. Under the new owner, the Tatas, Air India is

all geared up for a renovation as the sprawling company prepares to recast its

faltering aviation empire.

The transaction marked the country’s most

high-profile privatization under Prime Minister Narendra Modi, ending decades

of attempts to offload the money-losing,

debt-laden carrier that survived on years of taxpayer bailouts.

The deal will give the new entity a combined

Indian market share of 24%, making it a stronger competitor to IndiGo, which

has a 56% share, as well as full-service Middle Eastern rivals that carry a

large share of international traffic.

It will give Tata a fleet of 218 aircraft split

between plane makers Boeing and Airbus, making it India's largest international

carrier and second largest domestic airline.

SIA said it and Tata had agreed to participate

in additional capital injections in Air India if required to fund growth and

operations over the next two financial years.

"We will work together to support Air

India's transformation programme, unlock its significant potential, and restore

it to its position as a leading airline on the global stage," SIA Chief

Executive Goh Choon Phong said.

Etihad Cargo achieves IATA CEIV pharma recertification

Etihad

Cargo, the cargo and logistics arm of Etihad Aviation Group, has been awarded

Center of Excellence for Independent Validators (CEIV) Pharma recertification

by the International Air Transport Association (IATA). The carrier is one of

only 37 airlines to hold IATA CEIV Pharma certification globally.

The

UAE's national carrier first achieved IATA CEIV Pharma certification in 2019 in

conjunction with its hub at Abu Dhabi International Airport and Etihad Airport

Services Cargo. Etihad Cargo went on to become the first airline in the Middle

East and only the third globally to hold the trilogy of CEIV Pharma, CEIV Fresh

and CEIV Live Animals certifications.

Etihad

Cargo achieved IATA CEIV Pharma recertification following an audit by

independent validators that assessed the carrier's capacity to control and

enhance its processes through a checklist that focused on Etihad Cargo’s

Quality Management System that incorporates supplier management, training

programmes, processes and procedures, audit programmes, and quality

enhancement, among others. Achieving recertification demonstrates Etihad

Cargo's and its dedicated pharmaceutical transportation product PharmaLife's

full compliance with specific pharmaceutical regulations, including IATA

Temperature Control Regulations (TCR), Good Distribution Practices (GDP), a

quality system for warehouses and distribution centres dedicated to medications

and life sciences products.

Etihad

Cargo has significantly invested in its PharmaLife product since achieving IATA

CEIV Pharma certification for pharmaceutical logistics in 2019. In addition to

launching dedicated thermal covers for PharmaLife products across its top

pharma origin stations, Etihad Cargo recently announced the upcoming launch of

a new, state-of-the-art, 3,000-square-metre pharma facility at its Abu Dhabi

hub. The new facility, made possible through the carrier’s ongoing partnership

with Etihad Airport Services Cargo and Abu Dhabi Airports, will double Etihad

Cargo's cool chain capacity to carry and accommodate an additional 50,000

tonnes of cool chain commodities, including pharmaceuticals and life sciences

products.

Building

on the carrier's IATA CEIV Pharma-certified status, Etihad Cargo has committed

to raising standards across the pharma supply chain. As a founding member of

the HOPE Consortium, Etihad Cargo partnered with Abu Dhabi Airports Company

(ADAC), Brussels Airport Company and Pharma.Aero to launch Pharma Corridor 2.0

between Brussels and Abu Dhabi. This initiative aims to provide the highest levels

of assurance in the quality of handling to pharmaceutical shippers and

forwarders through the establishment of pharma corridors between airports with

cargo handling communities certified under the CEIV Pharma programme.

Atlas Air takes delivery of First of four new Boeing 777-200 freighters

Atlas

Air, Inc., a subsidiary of Atlas Air Worldwide Holdings, Inc., announced

it has taken delivery of a Boeing 777-200 Freighter, which it will operate on

behalf of its customer MSC Mediterranean Shipping Company SA, as part of a

previously announced long-term ACMI (aircraft, crew, maintenance, insurance)

agreement.

The

777-200 Freighter will complement MSC’s world-class container shipping

solutions and expand service to key trade lanes for various industries,

including those which traditionally have significant air cargo transportation

needs. This aircraft is the first of four new Boeing 777 Freighters that Atlas

will operate for MSC.

With

an established history of twin-engine efficiency, reduced fuel consumption, and

lower maintenance and operating costs, MSC enters the air cargo industry with

the longest-range twin-engine freighter in the world, capable of flying 4,880

nautical miles (9,038 kilometers). The 777-200F also meets quota count

standards for maximum accessibility to noise?sensitive airports around the

globe.

“We

are looking forward to this partnership with MSC, the world’s largest shipping

company, as they enter into air cargo,” said John Dietrich, President and Chief

Executive Officer, Atlas Air Worldwide. “We are pleased that all four of our

newly acquired 777-200Fs are placed on a long-term basis with MSC, providing

them with dedicated capacity to support their growth and expansion.”

“We

are delighted to see the first of our MSC-branded aircraft take to the skies

and we are looking forward to start serving the market with our new Air Cargo

solution,” said Jannie Davel, Senior Vice President Air Cargo at MSC. “We

believe that MSC Air Cargo is developing from a solid foundation thanks to the

reliable ongoing support of our operating partner Atlas.”

I reckon you have found this

information useful. Have a nice day!

Courtesy :

CAN, CFG & ISN.

Hope

you enjoyed reading the news. Have a nice day.

Thank

you and kind regards

Robert

Sands, Joint Managing Director

Jupiter

Sea & Air Services Pvt Ltd

Tel :

+ 91 44 2819 0171 / 3734 / 4041

Fax :

+ 91 44 2819 0735

Mobile

: + 91 98407 85202

E-mail

: robert.sands@jupiterseaair.co.in

Website

: www.jupiterseaair.com

Branches

: Chennai, Bangalore, Mumbai, Coimbatore, Tirupur and Tuticorin.

Associate Offices : New Delhi, Kolkatta, Cochin & Hyderabad.

Comments

Post a Comment