JUPITER SEA & AIR SERVICES PVT. LTD, EGMORE – CHENNAI, INDIA.

E-MAIL : Robert.sands@jupiterseaair.co.in Mobile : +91

98407 85202

Corporate News

Letter for Wednesday December 28, 2022.

|

Today’s Forex Rates : Source – The Economic Times:

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

:: Sea Cargo News ::

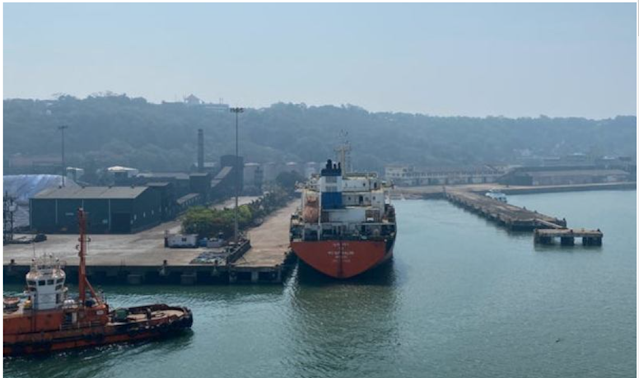

Cargo evacuation through Mormugao port hit as residents

protest truck movement

Evacuation of bauxite and coal cargo by road from Union government owned Mormugao Port has ground to a halt since 15 December as residents oppose the movement of these commodities by trucks through Vasco city citing pollution concerns, multiple sources said.

“Some

1,00,000 tonnes of bauxite cargo belonging to customers such as Hindalco

Industries Ltd and UltraTech Cement Ltd (both owned by the Aditya Birla Group)

are lying inside the port.

The

agitating residents are not allowing any material to move by road through the

two export-import gates of Mormugao port. About 30,000-40,000 tonnes of cargo

were expected to be moved out of the port by road in the last three days.

The port

will soon face a logjam,” a port official said. “It’s strange that some 10-15 people

have managed to stop cargo evacuation from the port by road completely for the

last three days. The State government machinery is not doing anything to

resolve the situation which is a law-and-order issue,” he said, asking not to

be named.

Bauxite

cargo arriving at the port on big ships are moved to the customers premises by

road only. About 10-20 percent of the coal shipped through the port is

evacuated by road and the rest by rail, which has not been affected by the

agitation.

India to finalise balanced FTAs with the EU, UK, Canada,

Israel and Gulf countries

India

has signed free trade agreements (FTAs) with key trade partners and is

finalising a 'balanced' FTA with the EU, UK, Canada, Israel and the Gulf

countries, Minister of State for Commerce & Industry Anupriya Patel said.

In her

address at EEPC India's 37th Western Region Award Presentation, the minister

added the FTAs are being signed to provide better market opportunities to the

country's exporting community.

"We

have signed FTAs with many of our key trading partners. We have the

Comprehensive Economic Cooperation and Partnership Agreement (CECPA) with

Mauritius, the Comprehensive Economic Partnership Agreement (CEPA) with UAE,

and the Economic Cooperation and Trade Agreement (ECTA) with Australia.

All

these are with an objective of providing better market opportunities to our

exporting community," Patel said. Mentioning about the government's recent

decision to withdraw export duty on specified steel items, Patel said that the

move would provide a fillip to the domestic steel industry and boost exports.

Maersk's extensive network can keep South China freight

moving

While

rival carriers brace for restricted South China cargo bookings, due to

feeder/barge service stoppages in the offing, Maersk claims it has reliable

alternatives to ward off the challenges tied to regional transhipment flows.

“Generally,

during the Chinese New Year holiday, some of our partners in the network are

unavailable and, in turn, our customers,” said a Maersk spokesperson. “However,

through our diverse portfolio of partners, we are able to serve our customers

without major hiccups during such situations.”

The

official also confirmed Maersk had placed no restrictions on bookings for South

China. By contrast, some major carriers, particularly CMA CGM, have already

advised customers of restricted bookings for shipments due to arrive at ports

in south China over several weeks in early 2023.

The move

was prompted by South China and Hong Kong feeder operators announcing temporary

service suspensions through next month, “due to Covid-19 quarantine

requirements for ship crews”. According to industry sources, those transhipment

complications are expected to run from late December through to mid-February.

Ocean carrier alliances prepare to deploy their new

mega-ships

THE

Alliance members Hapag-Lloyd, ONE, Yang Ming and HMM have finalised their April

network plans, which feature vessel upgrades on Asia to North Europe,

Mediterranean and US east coast services.

Lead

line Hapag-Lloyd said one of the key highlights would be the deployment of its

23,500 teu newbuild ULCVs on the Asia-North Europe tradelane to replace smaller

ships. In April, the carrier is due to start receiving the six LNG-fuelled

ULCVs from South Korean shipyard Daewoo Shipbuilding & Marine Engineering.

Announcing

the order, CEO Rolf Habben Jansen said the investment would see the carrier

“reduce slot costs and improve our competitive- ness” on the Asia-North Europe

tradelane. Hapag-Lloyd added that another highlight of next year’s network

enhancements was the addition of 14,000-15,000 teu ships on Asia-Mediterranean

services and on the transpacific between Asia and the US east coast.

Supply

chain intelligence platform eeSea analyst Patrick Fach-Pedersen said the only

significant adjustment to THEA’s network was the dropping of its PS8 Asia to

Pacific north coast loop, which it introduced in 2018, with other adjustments

limited to calls added or removed on existing services.

::// AIR

CARGO NEWS //::

Deutsche Bahn prepares for the sale of DB Schenker

Deutsche Bahn is preparing for the sale of

its freight forwarding subsidiary DB Schenker as it looks to focus on its core

rail business. The rail group said today that it has assigned its management

board to examine and prepare the case for a potential sale of up to 100% of its

shares in DB Schenker, the world’s fourth-largest airfreight forwarder.

“Decisions as to the categorical initiation

of a divestment process and the form any sale may take will be made separately

at a later date,” the company said.

The company reasoned that selling its

forwarding business would allow it to sharpen its focus on its Strong Rail

Strategy and core business.

“The objective of the Group strategy, which

was launched in 2019, is to shift traffic to environmentally friendly rail, in

both passenger and freight transport, and to expand the rail infrastructure in

Germany,” the company explained.

It added that while DB Schenker has

achieved record results in recent times, in the medium term the company will

require larger financial resources and more independence to make international

acquisitions with a view to retaining and enhancing its market position.

“For this reason, a sale could open up new

opportunities for DB Schenker in terms of growth and development,” Deutsche

Bahn said.

“The company’s position as a global market

leader makes it attractive for buyers and investors,” it added. “In the light

of the economic challenges being faced worldwide and current uncertainty on the

capital markets, DB does not want to rush a possible sale of DB Schenker.

“A starting date for a specific divestment

process is dependent on the overall situation and not yet decided. A sale shall

only take place if it is of financial advantage for DB Group compared to

keeping DB Schenker in the Group.”

In the first half of 2022, DB Schenker generated €1.2bn in operating profit, the best

mid-year result in the company’s 150-year history.

The company offers land, air and ocean

transport services and employs 76,100 people across 1,850 locations in more

than 130 countries.

The planned sale does not come as too much

of a surprise, there has been speculation for a number of years that Deutsche

Bahn had been unsure what it wanted for its freight forwarding subsidiary

with rumours of a sale most recently resurfacing in September.

Ongoing market consolidation in the

forwarding arena has seen the company lose its top-three status to fast-growing

Danish forwarder DSV in recent years, while the gap to market leader Kuehne+Nagel

and second-placed DHL Global Forwarding has been stretched.

Speculation will next turn to which

companies are potential buyers if Deutsche Bahn goes through with the sale,

with DSV one of the the most likely candidates.

The Danish forwarder has grown rapidly in

recent years through acquisitions and has in the past expressed an interest in DB Schenker should it be put up for sale.

Based on 2021 figures, were DSV to buy DB Schenker, it would become the world’s largest

airfreight forwarder, leapfrogging both K+N and DHL with annual volumes of

around 2.5m tonnes.

Writing on LinkedIn, supply chain

consultant Cathy Morrow Roberson said that she was leaning towards a break up

of the forwarder as the most likely outcome if it is put up for sale by

Deutsche Bahn.

However, she also said that Geodis could be

interesting to watch, while the cash-rich ocean carriers have been looking to

expand their presence in logistics over the last couple of years.

European Cargo receives

EASA certification for Airbus A340 freighter conversion programme

Bournemouth Airport-based carrier European Cargo has received EASA (European Aviation Safety Agency) certification for its Airbus A340 widebody freighter conversion programme.

The carrier, which anticipates further e-commerce growth opportunities, is converting a fleet of ex-passenger A340 aircraft into long-haul freighters.

The EASA certification paves the way for a

similar assessment by the UK’s Civil Aviation Authority (CAA), with European

Cargo anticipating CAA certification early next year.

European Cargo’s fleet is made up of former

Virgin Atlantic and Etihad Airbus A340 passenger aircraft. Its first conversion

is an ex-Virgin A340-600, once the world’s longest airliner stretching to 75.4m

or 247 feet and capable of carrying up to 370 passengers.

The conversion process has involved the

removal of all bulkheads, rear galley and toilets and replacing them with 39

pods in six different sizes. Each pod is covered by a fire containment bag

tested to withstand a lithium battery fire for six and a half hours.

It means that any fire can be contained to

a single pod, safeguarding the rest of the cargo and aircraft, and enabling a

safe diversion to a suitable landing location, even during long trans-oceanic

flights. Live testing at altitude has been carried out.

European Cargo’s managing director Iain

Edwards said: “EASA certification is a landmark moment in the development of

our fleet. Our pod containment system has proven itself through a rigorous

testing regime and means we are on track for full cabin utilisation, giving

each aircraft a combined belly and cabin capacity of 77 tonnes or 450 cubic

metres.

“With six freighters already at Bournemouth

for conversion and a further six available to us, that catapults us into the

No1 slot of UK-based wide-bodied carriers by some margin. And it makes

Bournemouth Airport a huge contender in the UK air freight market.”

European Cargo’s development takes place

as Bournemouth Airport aims to become a strategic airfreight hub.

Steve Gill, managing director at

Bournemouth Airport, which has its own dedicated freight operation, Cargo First, said: “We’d

like to congratulate Iain and his team on achieving EASA certification for their

first A340 conversion.

“It’s a great achievement and pending

further CAA approval paves the way for the introduction of hundreds of tonnes

of global freight capacity from Bournemouth in the New Year.

Combined with our location just 90 minutes

from London, we think 2023 will be a transformative year for air cargo

operations at Bournemouth Airport.”

CMA CGM Air Cargo explores

expanding its operations to Vietnam

Source:

CMA CGM

CMA CGM Air Cargo could expand its operations to Vietnam.

Discussions about investment in Vietnam took place during a meeting between CMA CGM Group’s vice-president for public affairs, governmental contracts & business development, Patrice Bergamini, and Phạm Minh Chính.

CMA CGM already has well established port

operations in the country.

On its website, CMA CGM says that since

1994 the CMA CGM Group has invested in port infrastructure in Vietnam through

its joint-venture partnership with Sowatco and Mitsui on First Logistics

Development Company’s Vietnam International Container Terminal (VICT) in Ho Chi

Minh City.

Another joint venture partnership with

Gemadept resulted in the establishment in the deep-sea water Gemalink terminal,

which started operations in January 2021.

CMA CGM Vietnam has over 250 staff, five

offices and 30 services throughout the country, including six at APM Terminals’

Cai Mep International Terminal, 50 km southeast of Ho Chi Minh City.

The potential investment comes as the air

cargo industry faces continued reduced demand. CMA CGM Air Cargo is leasing out

four of its freighter aircraft to Qatar Cargo and DHL’s express airline,

European Transport Leipzig (EAT), writes Air Cargo News’ sister title DVZ.

FreightWaves also recently reported that

CMA CGM Air Cargo is no longer selling space to freight forwarders on its own cargo jets operating to Chicago

and Atlanta from Europe. CMA CGM Air Cargo has unveiled major plans to develop

airfreight operations.

In May this year, CMA CGM Air Cargo

announced a ten-year partnership with Air France KLM covering the operation of freighters. CMA CGM Air Cargo plans to operate a fleet

of at least 12 freighters by 2026.

Guillaume Lathelize was appointed CMA CGM

Air Cargo’s new chief executive in October, taking over from Olivier Casanova who will

return to his previous role as deputy chief financial officer at CMA CGM.

GlobalX close to receiving

first A321 freighter conversion

Source: ST Engineering

Global Crossing Airlines’ (GlobalX) first Airbus A321 Passenger-to-Freighter (P2F) conversion has been completed. The aircraft has been converted by ST Engineering and is due to be delivered to Miami International Airport (MIA) this month.

In May 2021, GlobalX signed a letter of intent (LOI) to lease five A321P2F aircraft with ST Engineering’s Aviation Asset Management unit. These aircraft are being converted and leased to GlobalX progressively.

In a press release on December 13, GlobalX said its first A321 cargo aircraft (N410 GX) “will fly to the paint facility this week and is scheduled to arrive in Miami on December 20”.

A second A321 cargo conversion has also

been completed and the aircraft (N411 GX) “is undergoing some additional FAA

modifications,” said GlobalX. “It will join the fleet once the aircraft is

compliant.”

“We look forward to adding our first A321

freighter aircraft just before Christmas, followed soon by our second

freighter…” said Ed Wegel, GlobalX chairman and chief executive.

GlobalX also said in a LinkedIn post on

December 18: “Global Crossing Airlines first A321 freighter conversion is now completed-

4 hour test flight conducted yesterday, and now off to get painted in our “X

Cargo” livery. Tremendous effort by ST Engineering Wei Boon Lim Boon Keng TAN

and our maintenance team. MIA Arrival ceremony details coming soon for N410GX!”

In October, GlobalX signed a letter of

intent to lease 10 converted Airbus A321 freighters from the asset management specialist Vallair.

The A321P2F has a capacity of 14 upper deck

and 10 lower deck containers, which is 55% more containerised volume than the

Boeing B737-800 freighter and 14% more containerised volume than the B757-200F,

said GlobalX.

Additionally, it boasts an estimated 19%

lower fuel burn than the B757-200F, added the company.

I reckon you have found this

information useful. Have a nice day!

Courtesy :

CAN, CFG & ISN.

Hope

you enjoyed reading the news. Have a nice day.

Thank

you and kind regards

Robert

Sands, Joint Managing Director

Jupiter

Sea & Air Services Pvt Ltd

Tel :

+ 91 44 2819 0171 / 3734 / 4041

Fax :

+ 91 44 2819 0735

Mobile

: + 91 98407 85202

E-mail

: robert.sands@jupiterseaair.co.in

Website

: www.jupiterseaair.com

Branches

: Chennai, Bangalore, Mumbai, Coimbatore, Tirupur and Tuticorin.

Associate Offices : New Delhi, Kolkatta, Cochin & Hyderabad.

Comments

Post a Comment