JUPITER SEA & AIR

SERVICES PVT. LTD, EGMORE – CHENNAI, INDIA.

E-MAIL : Robert.sands@jupiterseaair.co.in Mobile : +91 98407 85202

Corporate News

Letter for Friday - November 29,

2024

Today’s Exchange Rates

|

CURRENCY |

PRICE |

CHANGE |

%CHANGE |

OPEN |

PREV.CLOSE |

DAY's LOW-HIGH |

|

84.49 |

0.029999 |

0.035518 |

84.45 |

84.46 |

84.45- 84.51 |

|

|

1.0549 |

-0.0017 |

-0.160886 |

1.0566 |

1.0566 |

1.0528- 1.057 |

|

|

106.8931 |

0.451797 |

0.424457 |

106.9602 |

106.4413 |

106.8545- 107.0256 |

|

|

88.995 |

0.183105 |

0.206172 |

89.1381 |

88.8119 |

88.9604- 89.2183 |

|

|

151.523 |

0.432999 |

0.286583 |

151.09 |

151.09 |

150.929- 151.951 |

|

|

1.2676 |

-0.0004 |

-0.031542 |

1.268 |

1.268 |

1.2645- 1.2683 |

|

|

106.367 |

0.282997 |

0.266767 |

106.161 |

106.084 |

106.102- 106.416 |

|

|

0.5562 |

-0.0012 |

-0.215278 |

0.5588 |

0.5574 |

0.5562- 0.5595 |

/// Sea Cargo News ///

The six workers unions at state-owned major ports have threatened to go on an indefinite strike from December 17 if the government fails to implement wage revision and a productivity linked reward scheme before December 15.

On September 27, the labour federations at

major ports deferred a planned strike after a settlement on revision of wages

and other service conditions including pensionary benefits was signed with the

Chairman, Bipartite Wage Negotiation Committee (BWNC) and the Managing

Director, Indian Ports Association in the presence of Regional Labour

Commissioner in Mumbai.

“Unfortunately, after having signed the settlement agreement, the management could not so far implement the settlement for reasons known to them alone,” the six workers federations said. The decision to resort to industrial action including indefinite strike from 17 December was taken at a meeting of the National Coordination Committee of the Port and Dock Workers held in Goa on November 23.

Benapole transport owners announce

indefinite strike, disrupting cross-border travel

The long-route transport owners of Benapole

have announced an indefinite strike starting Saturday morning, leading to

severe hardships for passengers on both sides of the border. Bablur Rahman

Babu, president of the Benapole Transport Association, said that a recent

meeting between local and transport authorities addressed the ongoing traffic

congestion in Benapole.

As a result of the congestion, authorities

ordered bus owners to relocate operations from the check post terminal to the

Kagoj Pukur terminal, located 4 kilometres away from Benapole, which has caused

significant inconvenience for travellers.

“In response to these changes, the Transport Owners Association has decided to halt all bus services between Dhaka and Benapole,” he added. For the past 20 years, buses traveling from Dhaka and Chattogram have been dropping passengers directly at the port’s checkpost terminal, with empty buses then parking at the terminal. However, recent changes now require these buses to drop passengers at a more distant terminal, causing security concerns and delays.

ZIM’s

financial recovery continues with strong Q3 results

Israeli ocean carrier ZIM has announced a net income of US$1.13 billion in the third quarter of 2024, while the company reported a US$2.27 billion loss in the same period last year.

Similarly, ZIM achieved EBITDA of US$1.53 billion in the third quarter, representing a year-over-year increase of 626% and operating income (EBIT) of US$1.23 billion, compared to an operating loss of US$2.28 billion in the third quarter of 2023.

Eli Glickman, ZIM President & CEO,

commented, “ZIM delivered strong third-quarter results, as we again achieved

record carried volumes contributing to our outstanding financial performance.

We are pleased to share our success with our shareholders and declare a special

dividend of US$100 million on top of the regular 30% of quarterly net income

dividend payout of US$340 million, for a total dividend of US$440 million, or

US$3.65 per share.”

“We’ve continued to see incremental benefits

from our strategic investment in our operated capacity as new larger, more

modern, cost-effective vessels join our fleet,” added Glickman.

Summary of Key Financial and Operational

Results

|

Q3-24 |

Q3-23 |

9M-24 |

9M-23 |

|

|

Carried volume (TEUs) |

970,000 |

867,000 |

2,768,000 |

2,496,000 |

|

Average freight rate (US$/TEU) |

2,480 |

1,139 |

1,889 |

1,235 |

|

Total revenues (in million US$) |

2,765 |

1,273 |

6,260 |

3,957 |

|

Operating income (loss) (EBIT) (in million

US$) |

1,235 |

(2,276) |

1,870 |

(2,457) |

|

Profit (loss) before income tax (in million

US$) |

1,133 |

(2,342) |

1,604 |

(2,678) |

|

Net income (loss) (in million US$) |

1,126 |

(2,270) |

1,591 |

(2,541) |

|

Adjusted EBITDA1 (in million

US$) |

1,531 |

211 |

2,725 |

859 |

|

Adjusted EBIT1 (in million

US$). |

1,236 |

(213) |

1,891 |

(373) |

|

Net income (loss) margin (%) |

41 |

(178) |

25 |

(64) |

|

Adjusted EBITDA margin (%) |

55 |

17 |

44 |

22 |

|

Adjusted EBIT margin (%) |

45 |

(17) |

30 |

(9) |

|

Diluted earnings (loss) per share (US$) |

9.34 |

(18.90) |

13.17 |

(21.19) |

|

Net cash generated from operating activities

(in million US$) |

1,498 |

338 |

2,600 |

858 |

|

Free cash flow (in million US$) |

1,454 |

328 |

2,470 |

791 |

|

|

SEP-30-24 |

DEC-31-23 |

|

|

|

Net debt (in million US$) |

2,698 |

2,309 |

|

|

Regarding the first nine months of the year,

ZIM’s total revenues have climbed to US$6.26 billion, primarily driven by both

an increase in freight rates as well as carried volume.

ZIM carried 2,768,000 TEUs during this period

with an average freight rate per TEU of US$1,889.

The company’s EBIT for the first nine months of

2024 was US$1.87 billion with the growth primarily driven by the

above-mentioned increase in revenues and the impairment loss recorded in the

third quarter of 2023. For the same period, ZIM reported a net income of

US$1.59 billion, while net cash generated from operating activities was US$2.6

billion, compared to US$858 million for the first nine months of 2023.

The Company increased its guidance for the full

year of 2024 and now expects to generate adjusted EBITDA between US$3.3 billion

and US$3.6 billion and adjusted EBIT between US$2.15 billion and US$2.45

billion.

ZIM’s boss stated, “Also contributing to our

strong Q3 was a decision we made earlier in the year to increase our exposure

to spot volumes in the Transpacific trade. A key differentiator for ZIM is our

commercial agility and we intend to continue to leverage this strength to

capitalize on market opportunities moving forward. Based on results that have

exceeded expectations to date and improved outlook for the fourth quarter of

2024, we have increased our full year 2024 guidance.”

Glickman concluded, “We will close out the year

with the final delivery of the remaining four out of 46 newbuild containerships

that we secured, which include 28 LNG-powered vessels. Entering 2025, we will

be operating a fleet that is both well-equipped to meet emissions reduction

targets and well suited to the trades in which we operate. Supported by our

declining unit costs, we believe ZIM is well positioned to deliver profitable

growth over the long term.”

Strategic

stockpiles and peripheral ports in Chinese trade mindset

Strategic inventories have a profound impact on

the shipping sector by influencing operations, logistics planning, and even the

configuration of global shipping routes.

As Container News reported,

Peter Sand, chief analyst at Xeneta, highlighted Mexico, Latin America, and the

Middle East as critical markets for China’s exports, pointing out that Chinese producers have been amassing “strategic stockpiles” to mask the origins of their goods in case tariffs are

implemented.

Ports that handle these strategic stockpiles

may witness heightened activity, requiring advanced logistical solutions to

manage greater throughput volumes. Additionally, the need for nearby

warehousing and storage solutions might stimulate infrastructure investments or

modifications in port logistics services to support longer storage periods.

ONE announces intra Europe trade SCX & IBC service revamp

Ocean Network Express is pleased to announce

the launch of SCX (Scandinavia Express) and IBC (Iberia

Europe) Services, tailored to enhance operational efficiency and schedule

reliability. These revamped services

reflect the commitment to optimizing their network and providing you with

reliable shipping solutions.

SCX (Scandinavia Express) – Service Rotation

Rotterdam - Gothenburg - Helsingborg - Aarhus - Copenhagen – Rotterdam.

IBC (Iberia Europe) – Service Rotation

Rotterdam - Leixões - Lisbon - London Gateway - Bremerhaven -Rotterdam.

Service Details and Launch Schedule

- SCX (Scandinavia Express): Relaunch

effective from M/V CPFT0018N/S.

- IBC (Iberia Europe): Relaunch effective

from M/V WGGT0066N/S.

Ocean Network Express is believes these

re-launches will significantly enhance their logistics planning and strengthen

their partnership.

Port of Los Angeles exceeds 900,000 container units

The Port of Los Angeles handled a record 905,026 Twenty-Foot Equivalent Units (TEUs) in October, a 25% increase over the previous year. It's the first time the Port has exceeded 900,000 TEUs for four consecutive months.

Ten months into 2024, the Port of Los Angeles has moved 8,491,420 TEUs, 19%

ahead of its 2023 pace.

"These robust, sustained volumes will likely continue in the coming months

with strong consumer spending, an early Lunar New Year, importer concerns about

unresolved East Coast labor issues and the possibility of new tariffs next year

that could drive up shipping costs," said Port of Los Angeles Executive

Director Gene Seroka.

"I'm grateful to our dockworkers, truckers, terminal operators and others

who handle these record levels of cargo every day. They have done it with

speed, efficiency and without a single ship backed up at sea," Seroka

said.

Mary E. Lovely, a Senior Fellow at the Peterson Institute of International

Economics, joined Seroka at today's media briefing. Lovely discussed the

potential impact of additional tariffs against products made in China and other

countries that are expected to be implemented by President-elect Donald Trump.

October 2024 loaded imports landed at 462,740 TEUs, a 24% increase compared to

the previous year. Loaded exports came in at 122,716 TEUs, a 1% increase

compared to 2023. The Port processed 319,570 empty containers, a 38% jump

compared to 2023.

/// Air Cargo News ///

The

Indian electronics sector is pushing for major expansions in airport cargo

handling to support a forecasted boom in device exports. According to the India

Cellular and Electronics Association (ICEA), India's existing airports are near

capacity, creating bottlenecks in export logistics.

ICEA

Chairman Pankaj Mohindroo highlighted delays in customs processing as a

significant issue, noting that in India, export take-off occurs on Day 2

compared to Day 1 in China. The industry also faces challenges with inadequate

cargo operations facilities at current airports.

With

electronics manufacturing expected to achieve USD 500 billion by 2030, airport

expansions and new infrastructure developments, such as Noida International

Airport and greenfield airports, are deemed essential. Strategies include tax

incentives and aviation fuel price rationalization to foster growth.

Land parcels examined for new Srikakulam airport

A

five-member team from the Airport Authority of India (AAI) visited Srikakulam

district to assess suitable locations for the proposed airport

construction. The airport initiative was initially proposed by chief

minister Nara Chandrababu Naidu during his recent district visit.

The

AAI delegation, headed by DGM Parvinder and accompanied by Malkit Singh, KP

Venkata Raman, Sunil Kumar, and Sheik Abdul Azeez, examined the land parcels in

five villages in Mandasa and Vajrapukotturu, that the district administration

had shown them.

Palasa

RDO Venkatesh and tahesildars Hymavathi (of Mandasa) and Sitarramaiah (of

Vajrapukotturu), joined the delegates and inspected several potential land

parcels in these mandals.

The

district officials reported that the team visited several villages including

Ganguvada, Betalapuram, Lakshmipuram, Bidimi in Mandasa mandal, and Anakapalli

and Onkuru in Vajrapukotturu mandal.

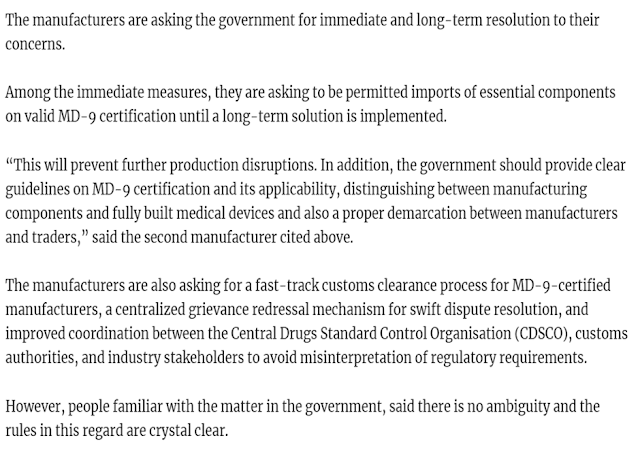

Delay in clearing imports hits India’s medical industry

Prolonged

delays in clearing imports of essential components has resulted in disruptions

in the manufacture of medical devices, people in the business said, adding that

this could affect the government’s Make-in-India scheme in the long run.

“Despite

full regulatory compliance, a lack of policy clarity among regulatory

authorities has led to stalled shipments, severely affecting production

timelines and jeopardizing health care services,” said a manufacturer of X-ray

device, requesting anonymity.

According

to the manufacturers of critical devices such as X-ray and C -Arm machines,

even though they are equipped with valid so-called MD- 9 certifications as

required under India’s Medical Devices Rules, they are encountering unexpected

demands for additional import licenses.

“It

is being sought for components such as flat panel detectors (FPDs), which is

contrary to the certification’s established scope as these components are

integral to manufacturing and not standalone devices,” said the manufacturer

cited above.

These delays have persisted for nearly three months, causing production disruptions, missed delivery deadlines and restricted availability of life saving diagnostic tools etc the manufacturers claimed.

ACIA

Aero Leasing, a leading provider of regional aircraft leasing and lease

management services, announced the sale of an ATR 72-500 LCD freighter (MSN727)

to Canadian regional airline, Air Creebec.

The

aircraft is the airline’s first ATR to be introduced to its fleet. The aircraft

will enter operations in December 2024, serving Air Creebec’s multiple cargo

contracts throughout Canada.

Originally

converted to a bulk freighter in 2021, the aircraft has been upgraded with a

Large Cargo Door (LCD) at Empire Aerospace, in Idaho, USA.

“We

welcome Air Creebec as a new customer and are delighted they approached ACIA

Aero Leasing for their first ATR. The Canadian market represents multiple

opportunities for the ATR platform across both passenger and cargo requirements

and we see strong potential to further strengthen our customer base in this key

market.

The

fact that we were able to reconfigure the aircraft from standard BFC to LCD

variant, incorporating the large cargo door, maintenance and paint in under 6

months, reaffirms our leadership in the market for ATR freighter solutions,”

commented Mark Dunnachie, SVP Commercial, ACIA Aero Leasing.

“We

are delighted to be taking delivery of our first ATR aircraft from ACIA Aero

Leasing. The LCD variant will afford us greater flexibility in our cargo

operations as we improve essential access to food and necessities to our remote

clients in the far North.

As

the main airline in our region, Air Creebec needs to provide innovative

solutions to our vast variety of clients. With our new LCD ATR72-500 from ACIA,

we are proud to be the pioneer and leader in cargo transportation in our area

and are very excited to further develop our expertise” commented the airline’s

President and CEO, Tanya Pash.

DHL

Express and Shell, one of the world's largest energy companies, have signed a

deal to drive sustainable air freight at Brussels Airport. The 1-year deal

includes the delivery of 25 kt SAF into Brussels via pipeline to the airport.

The

SAF used is certified according to ISCC’s voluntary certification system

"ISCC Plus" and is expected to reduce GHG by 80 kt CO2e versus fossil

jet-fuel. It is produced in a fossil refinery by replacing fossil crude oil

with renewable feedstocks (co-processed SAF) and will be used to offer DHL

Express customers emission reduced air transportation services via DHL GoGreen

Plus.

"Our

customers benefit from our continuously increasing SAF coverage across

different regions, now including our investment in SAF at Brussels Airport.

Beside efficiency improvements, SAF is currently the most important way to

reduce GHG emissions in air transport.

Customers

can actively contribute to making their supply chains more sustainable by using

our GoGreen Plus service based on SAF", says Travis Cobb, EVP Global

Network Operations and Aviation at DHL Express.

"Our

collaboration with DHL at Brussels Airport reflects a joint commitment to

reduce emissions from air freight specifically, and across the entire aviation

value chain. Working together not only complements their efforts but also helps

advance our shared ambitions for a net-zero future.

By

supplying SAF, we are equipping the industry – and our customers – with low

carbon solutions that will support the transition toward sustainable

aviation", says Raman Ojha, President at Shell Aviation.

Insetting

through DHL Go Green Plus enables customers to reduce their Scope 3 emissions -

the indirect GHG emissions generated in a company's value chain, including

downstream transportation and distribution.

In

contrast to offsetting initiatives, DHL GoGreen Plus (insetting) reduces GHG

emissions within the logistics sector and can therefore be used by DHL

customers for voluntary emissions reporting based on the "book and claim

approach".

DHL

has set itself the goal of reducing all logistics-related emissions to net zero

by 2050. The GoGreen Plus service is designed to help achieve this goal. It

contributes to the interim target of using 30 percent SAF for all air

transportation by 2030.

I hope you have enjoyed reading the above news letter.

Robert Sands

Joint Managing Director

Jupiter Sea & Air

Services Pvt Ltd

Casa Blanca, 3rd Floor

11, Casa Major Road,

Egmore

Chennai – 600 008.

India.

GST Number :

33AAACJ2686E1ZS.

Tel : + 91 44 2819 0171

/ 3734 / 4041

Fax : + 91 44 2819 0735

Mobile : + 91 98407

85202

E-mail : robert.sands@jupiterseaair.co.in

Website : www.jupiterseaair.com 1Branches : Chennai, Bangalore, Mumbai, Coimbatore,

Tirupur and Tuticorin.

Associate Offices : New

Delhi, Kolkatta, Cochin & Hyderabad.

Thanks to : Container News, Indian Seatrade & Air Cargo News.

Comments

Post a Comment