JUPITER SEA & AIR SERVICES PVT. LTD, EGMORE – CHENNAI, INDIA.

E-MAIL : Robert.sands@jupiterseaair.co.in

Mobile : +91 98407 85202

Corporate

News Letter for Wednesday March 01, 2023.

:: Today’s Exchange Rates ::

Source : The Economic Times.

|

CURRENCY |

PRICE |

CHANGE |

%CHANGE |

OPEN |

PREV.CLOSE |

DAY's LOW-HIGH |

|

82.66 |

-0.189995 |

-0.229324 |

82.71 |

82.85 |

82.625- 82.755 |

|

|

1.0616 |

0.0007 |

0.065981 |

1.061 |

1.0609 |

1.0582- 1.0626 |

|

|

99.8184 |

0.622398 |

0.627443 |

99.7065 |

99.196 |

99.4705- 99.9776 |

|

|

87.674 |

0.255005 |

0.291704 |

87.6273 |

87.419 |

87.518- 87.8179 |

|

|

136.766 |

0.576004 |

0.422941 |

136.19 |

136.19 |

136.117- 136.848 |

|

|

1.211 |

0.0046 |

0.381294 |

1.2064 |

1.2064 |

1.2028- 1.2114 |

|

|

104.64 |

-0.032997 |

-0.031524 |

104.629 |

104.673 |

104.577- 104.891 |

|

|

0.6047 |

-0.0048 |

-0.787525 |

0.6083 |

0.6095 |

0.6043- 0.6085 |

:: Sea Cargo News ::

Flour millers import 14,000 tonnes wheat so far to

re-export as atta

Some players have made a case for opening up of exports of wheat

flour Flour millers have, so far, imported about 14,000 tonnes of wheat under

the advance authorisation scheme for processing into wheat flour ( atta) since

November 2022 when flour export, otherwise banned, was allowed under the

scheme, according to official sources.

Small-scale

millers and traders argue that this is a small amount compared to the demand

for wheat flour from the expat community, as only large players, with adequate

infrastructure, have been in a position to benefit from the advance

authorisation scheme.

Some

have made a case for opening up of exports of wheat flour, so that all millers

can benefit from it, with adequate restrictions to ensure there was no domestic

shortage or price rise.

“The

advance authorisation scheme may help a couple of big companies, such as ITC,

who have the infrastructure to import wheat, process it and re-export in the

form of atta. But the process is so cumbersome that normal traders are not

interested,” a Delhi-based miller, who did not wish to be named, told.

Russia & India Introduce Direct Novorossiysk – Mumbai

Shipping Route

Russia’s Far Eastern Shipping Company (FESCO) has begun a new

direct shipping route between Novorossiysk on Russia’s Black Sea Coast and

Mumbai on the West coast of India.

The

company stated that “FESCO Indian Line operates on the route

Novorossiysk-Ambarli (Turkey)-Nhava Sheva (India)-Mundra (India) and back. The

main cargo traffic on this service is food products, cellulose, polymer

materials and others. Hazardous cargo is also accepted for shipping.”

The

Nhava Sheva and Mundra ports are parts of the overall Mumbai port complex. The

city is India’s commercial hub possessing an affluent consumer population in

its own right as well as rail and road transport networks to the rest of the

country.

Novorossiysk

is on the Russian Black Sea coast and is the Black Seas largest regional port.

It is listed on the Moscow Stock Exchange and services Russian sea trade with

regions of Asia, Middle East, Africa, Mediterranean, and South America.

It is

the busiest oil port in the Black Sea and the terminus of the pipeline from the

Tengiz Field, developed by the Caspian Pipeline Consortium.

India foreign trade crosses $1tn in 2022. Record $100bn imports

from China widen deficit

India’s international trade crossed the $1 trillion mark for the

first time in the year ending December 2022. However, data from the Ministry of

Commerce and Industry show that this has come with a record high trade deficit

— over $85 billion — with China.

An analysis of the official data also highlights the rising

concentration of the neighbouring country in India’s overall imports over the

past 10 years. According to the data for January-December 2022, with exports

worth $453 billion and imports to the tune of $723 billion, India’s overall

international trade reached $1.17 trillion, 21 per cent above the previous

year’s $969 billion.

India’s trade deficit — excess of imports over exports — stands at

$270 billion, about 51 per cent higher than $178 billion in 2021. An analysis

of India’s foreign trade statistics shows that while international trade has

risen by 15 per cent on average in the past 10 years, both India’s exports and

imports have become slightly more concentrated, or limited to fewer countries.

India to soon trade in rupee with UAE, Malaysia and Nigeria

After Russia, trade settlement in Indian rupee will soon be

possible with the UAE, Malaysia and Nigeria. The rupee-dirham trade settlement

is expected anytime soon as senior finance and bank officials from India are on

a three-day trip to Abu Dhabi to finalise the details of the deal.

A report by Business Standard quoted sources saying India may also

ink pacts with Malaysia, and Nigeria to facilitate settlement of international

trade in local currencies by next month. Once effective, the transaction costs

for exporters and importers will be reduced.

As per the report, officials from India’s central bank – Reserve

Bank of India (RBI) – are in discussion with their counterparts in UAE, Nigeria

and Russia over the last few months to work out on rupee trade mechanism with

the local currencies of the countries.

UAE is India’s third largest trading partner after US and China.

The report quoted people aware of the development saying discussions with the

UAE are at an “advanced stage” and talks with Malaysia and Nigeria are

progressing well. “Memorandums of understanding (MoUs) can be signed as early

as next month,” they said.

Ministry of Corporate Affairs approves revised demerger

plan of SCI

The Ministry of Corporate Affairs, on Thursday, approved the

revised demerger plan of Shipping Corporation of India (SCI). Under the revised

plan, Rs 1000 crore will be transferred to the non-core assets.

The moe will pave way for divestment of SCI, which is expected to

be completed by FY24. According to an exchange filing on BSE, SCI board had

approved the Demerger Scheme for hiving off the identified non-core assets of

the company on August 3, 2021.

Subsequent to the instructions of Ministry of Ports, Shipping and

Waterways (MoPSW), SCI incorporated a 100 per cent subsidiary Shipping

Corporation of India Land and Assets Limited (SCILAL) in November 2021 for the

demerger of 'non core' assets.

The approval for strategic divestment of SCI was given by the Union

Cabinet in November 2019. "Preliminary Information Memorandum (PIM) /

Expression of Interest (EOI) was floated on 22.12.2020 for strategic divestment

of entire 100% shareholding of Government of India (“GOI”) equity stake of

63.75% in Shipping Corporation of India Limited.

Hamad Port crosses 8mn container throughput mark since

becoming operational

Hamad Port has crossed the 8mn container throughput milestone since the start of operations in December 2016, indicating the growing importance of Qatar in the regional and international maritime space.

"This significant achievement reinforces the confidence the shipping lines have in Hamad Port’s facilities and QTerminals’ safe services, competency and performance," the terminal operating company said in a tweet.

The achievement of the 8mn TEUs (twenty-foot equivalent units)

mark will further encourage shipping lines to add Hamad Port in the rotation of

their mainline services calling the Middle East region and use it as one of the

regional transshipment hubs, according to QTerminals.

In 2022, Mwani Qatar continued its efforts to transform the

country into a vibrant regional trade hub by strengthening the role of Hamad

Port as a pivotal gateway for transshipment in the region. Hamad Port's

strategic geographical location offers opportunities to create cargo movement

towards the upper Gulf, supporting countries such as Kuwait and Iraq and south

towards Oman.

Utilisation

pushes freight rates down, except Atlantic, reports Sea-Intelligence

Sea-Intelligence analysis shows that during the pandemic period, a mix of high demand and loss of capacity due to vessel congestion resulted in record vessel usage rates, which in turn resulted in a rise in spot rates, both of which peaked in February 2022.

However, vessel utilisation has fallen significantly since then;

in the case of the Transpacific, it has now returned to pre-pandemic levels,

whereas in the case of Asia-Europe, it initially fell below pre-pandemic

figures but has now returned to pre-pandemic levels.

According to Sea-Intelligence, depending on whether utilisation

is growing or declining, the dynamic between utilisation and market rates

changes. When Transpacific utilisation was rising, spot rates stayed largely

constant at a low level until a trigger point of around 90% nominal vessel

utilisation caused a sharp rise in spot rates.

"When utilisation levels started to decrease since the peak

in February 2022, we see a much more linear relationship between utilisation and

spot rates, as illustrated in Figure 1 for the Transpacific trade," said

Alan Murphy, CEO of Sea-Intelligence.

Murphy went on to explain, "We see the same general pattern

for Asia-Europe, although with a bit more noise. Overall, the rate developments

in the Transpacific and Asia-Europe trades match expectations very well, if the

assumption is a market operating with a close link between supply, demand, and

pricing."

However, as Sea-Intelligence data shows, there appears to be no

obvious link between utilisation and spot rate levels in Transatlantic traffic.

Unlike the Transpacific and Asia-Europe trades, falling utilisation levels have

so far had no effect on trade pricing, suggesting that another mechanism must

be at work in setting rate levels for this particular trade.

Container

vessel catches fire in Gulf of Riga, crew abandons the ship

Escape / Source:

Latvian navy

A fire broke out in the engine room of the Dutch-flagged

container ship Escape, while it was sailing in the Gulf of Riga in Latvia on 22

February.

All the crew members of the vessel abandoned the ship after

unsuccessful attempts to extinguish the fire. The 15 seafarers evacuated the

vessel using a lifeboat before a nearby cargo ship Kairit transfer them to

Riga.

The cause of the fire incident is still unknown and it is not

yet clear whether Escape was carrying hazardous cargo. The route of the boxship

was from the port of Klaipeda in Lithuania to the port of Riga in Latvia.

According to the Latvian naval's release, the ship carries

"dangerous cargo", without specifying the precise nature of the

cargo. Later, it was stated that the cargo consisted of polymers and paint

materials, though these have not caught fire.

Two tugboats, Stella and Orion, which are equipped with water

tanks and foam generators, seem to have been involved in the fire

extinguishing.

::

Air Cargo News ::

Noida International Airport to be operational by Sep,

2024, informed the UP Government

The much-anticipated Noida International Airport- the country’s

largest airport, is set to open in September 2024. The airport’s construction

in Greater Noida in the National Capital Region (NCR), has been accelerated

with nearly all of the requisite land obtained.

UP Chief Secretary Durga Shankar Mishra, who inspects the progress

of Noida International Airport on a monthly basis, informed about the

development. The officer said that the airport would be open to the public in

September 2024, with flights beginning soon thereafter.

Flughafen Zrich AG, the operator of Zurich Airport in Switzerland,

which won the contract to develop and manage the airport for 40 years starting

in 2019, is also optimistic that the project would be completed on schedule,

informed the HS.

At the Global Investors Conference 2023 in Lucknow, Daniel

Bircher, CEO of Zurich Airport Asia, had declared that the Noida International

Airport will be a real embodiment of Swiss efficiency and Indian friendliness.

“Noida International Airport will act as a gateway to ease of doing business in

Uttar Pradesh,” he added. The airport, according to the chief secretary, is an

ambitious initiative of UP.

Dip in international cargo handled at Mangaluru International Airport

The international cargo handled at the Mangaluru International

Airport has seen a dip in the last two months, after the stoppage of a daily

SpiceJet flight to Dubai.

On average, AAI Cargo Logistics and Allied Services Company

Limited (AAICLAS) used to handle around 8-10 tonnes of international cargo

every day. However, currently, it is reduced to almost half, said KA

Sreenivasan, senior manager (cargo), AAICLAS, Mangaluru. International flights

operating to UAE, Kuwait, Bahrain, Saudi Arabia, Oman, and Qatar, airlift

perishables like vegetables and fruits from Mangaluru.

Sreenivasan said that until December 15, SpiceJet, Air India

Express, and Air India flights used to carry cargo to various Gulf countries.

However, after the stoppage of the SpiceJet flight to the UAE on December 15,

only AIE and AI have been continuing the cargo services. IndiGo, which also

serves the Gulf sector, does not lift cargo.

“SpiceJet had a daily flight to Dubai, and it carried about 2-3

tonnes to Dubai, on every trip. However, the cargo sector has not been affected

by ongoing airport recarpeting work at MIA,” said Sreenivasan.

Kenya Airways Cargo looks to expand freighter fleet

Kenya Airways Cargo is looking to expand its freighter fleet

following the success of its cargo-only flights during the Covid pandemic.

Speaking on the sidelines of the Air Cargo Africa event in

Johannesburg, Kenya Airways’ cargo director Dick Murianki said the carrier

would initially look to add to its existing short-haul freighter fleet, which

currently consists of two B737-300Fs.

Murianki said that the carrier was hoping to add two B373-800Fs,

which have better range and can reach further afield than the existing

freighters.

“They can go from Nairobi to the Middle East and India and even

have the range to reach Istanbul and southern Europe carrying around 20 tonnes,”

he explained.

He said that once the two B737-800Fs are in place, the carrier

would then examine long-haul freighters.

On the reasoning behind the freighter investments, Murianki said

that during the Covid crisis the airline had expanded its cargo operations

using its passenger aircraft.

“We developed a customer base during the Covid time that is

yearning for more, especially to the Middle East and India,” he said.

Speaking at a conference session later in the day, Kenya Airways

chief executive Allan Kilavuka said that two

B787-9 Dreamliners had been used on cargo-only flights to

long-haul destinations in China and Europe during the pandemic, with each

aircraft able to carry around 50 tonnes per flight.

He said the operation had “proved the case” for long-haul cargo

flights. He added that outbound volumes during the cargo-only operation had

been much stronger than inbound, but there could be an opportunity to use the

airline’s home base of Nairobi as an import hub for the rest of Africa.

Freighters – compared with bellyhold operations – would also

allow the carrier to operate long-haul flights to airports where the passenger

demand isn’t strong enough to justify the use of larger aircraft, he added.

FedEx faces threat of pilot

strike

Photo: FedEx

The FedEx Express Master Executive Council (MEC) of the Air Line Pilots Association, Int’l (ALPA) has unanimously approved a resolution setting the stage for a strike authorisation vote.

Contract negotiations between the pilots and FedEx management have stalled, and no future talks are scheduled, said ALPA in a press release on February 22. The parties have been in negotiations since May 2021.

“The decision to move closer to a strike authorisation vote is the result of nearly six months of federally mediated negotiations that has led to our disappointment with FedEx management’s actions at the bargaining table,” said Captain Chris Norman, FedEx MEC chair.

The FedEx pilots will utilise the full resources of the Railway

Labor Act (RLA) as permitted by law—up to and including a strike—to get an

industry-leading contract, said ALPA. Under

the RLA, before a strike can occur, the pilots must be released by the National

Mediation Board, and a 30-day cooling-off period must be exhausted.

The strike authorisation vote is another necessary requirement. “FedEx

pilots are committed to reaching a deal with management, but we will not waiver

in our commitment to deliver a contract that rewards pilots for their

sacrifices to build FedEx into the global leader it is today,” said Norman.

“Although a strike authorisation vote has not been called at

this time, our customers and shareholders should be aware that the pilots may

be headed in that direction shortly.”

Founded in 1931, ALPA is the largest airline pilot union in the

world and represents more than 67,000 pilots at 39 U.S. and Canadian airlines.

Visit ALPA.org or follow us on Twitter @ALPAPilots.

ECS Group subsidiary Wexco Group has signed a GSSA contract with

Teleport, the logistics venture of Capital A (formerly known as AirAsia) that

covers Australia operations for three airlines.

The contract covers AirAsia X, Thai AirAsia X, and Indonesia

AirAsia, for all belly capacity originating from Australia and New Zealand.

The contract puts Wexco in charge of filling a total of 43

flights per week out of Sydney, Perth, and Melbourne, with an average weekly

uplift of 120 tons.

With this, both Teleport and Wexco Group are expected to

facilitate the strong movements of perishable cargo, health food supplements,

electrical goods, general cargo (consolidations), and mail within the region.

AirAsia X’s 22 weekly flights operated with widebody A330-300

aircraft, include daily services from Sydney to Auckland, and Kuala Lumpur.

Kuala Lumpur is also served four times a week out of Melbourne,

and four weekly from Perth. The airline’s main hub offers a multitude of

connections across its vast Asian network, covering prime global cargo hubs such

as Taipei in Taiwan, and Incheon in South Korea.

“We are excited to collaborate with Wexco as a partner, who

brings onboard their robust experience and quality customer service to help

better serve our cargo customers in this region. This is in line with

Teleport’s growth strategy for Australia and New Zealand, where businesses here

can also take advantage of our extensive ASEAN network for further distribution

into the region” said Francis Antony, group head of cargo commercial at

Teleport.

Thai AirAsia X runs seven weekly flights, also deploying

A330-300 widebodies: three weekly services from Melbourne to Bangkok, and four

weekly flights from Sydney to Bangkok. These flights can be booked to connect

to popular cargo destinations within the Asia Pacific region, namely Japan and

India, amongst others.

Indonesia AirAsia operates 14 weekly flights operated with

narrowbodies A320 aircraft, twice daily between Perth and Denpasar.

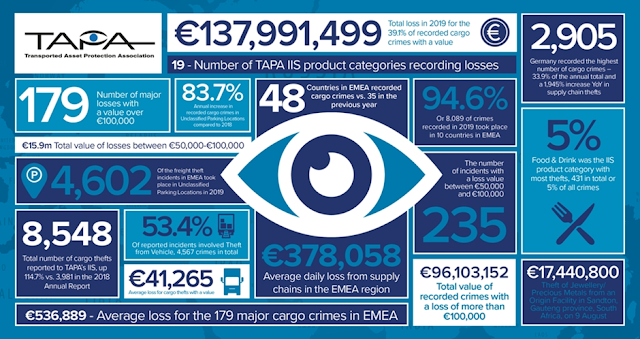

EMEA cargo crime continues

to climb

Cargo thefts from supply chains in Europe, the Middle East and

Africa (EMEA) more than doubled to 8,548 incidents in 2019 and involved losses

of product worth well over €137m, according to the Transported Asset Protection

Association (TAPA).

The incident rate is the highest recorded in TAPA’s 23-year

history and reflects criminal attacks on all modes of transport; air cargo,

ocean freight, road freight and rail freight.

In its Incident Information Service (IIS) Annual Report 2019,

the association also reveals average losses for major cargo crimes of €536,889

and an average daily loss in the EMEA region last year of €378,058.

The intelligence data is based on cargo losses reported to

TAPA’s IIS by international law enforcement agencies, insurers, manufacturers

and logistics service providers.

Despite the high numbers, however, the association continues to

emphasise that it is still not receiving reports on the large majority of cargo

crimes it believes are taking place across the region.

In 2019, the number of incidents rose 114.7% to 8,548 versus 3,981

in 2018.

The biggest single loss reported to TAPA’s IIS in 2019 was the

theft of €17.4m of jewellery/precious metals stolen from an Origin Facility in

Gauteng province in South Africa. This was one of 19 crimes with 7- and

8-figure loss values.

Trucks continued to be the biggest target for cargo thieves,

featuring in some 95% of all freight losses in the EMEA region.

The lack of secure truck parking remained one of the most

significant contributors to these crimes, with drivers forced to park their

vehicles at service stations, in laybys and on industrial estates while taking

mandatory rest breaks.

Qatar Airways Cargo partners with iNOMAD, an all-in-one air cargo

platform

The partnership with iNOMAD will enable better connectivity for one of the airline’s major customers in South Korea, Woojung Air and also help the airline increase its footprint in South Korea as SMEs operating with Woojung Air will be able to compare Qatar Airways Cargo’s offerings on the iNOMAD portal. Woojung Air is a prominent consolidator in South Korea and one of the top customers of Qatar Airways Cargo.

Mr.

Guillaume Halleux, Chief Officer Cargo at Qatar Airways said, “Digital

transformation is high on our agenda as part of our VISION 2027 and Next

Generation Strategy. The integration and partnership with iNOMAD brings

multiple benefits to our customers in South Korea such as enhanced visibility

of our capacity, rates as well as real time confirmation of their shipments.

Customers can benefit from instant access to these features at their fingertips

and that is the huge advantage digitalisation brings in.”

Joon-suk Yim, the CEO of iNOMAD, said, "Its strength is to promote the

accessibility of air cargo service by optimizing extensive logistics data for

clients and provide boundless service and information to both IATA/CASS members

and non-members in real-time. Developing this business, we are grateful and

proud to start a new partnership with Qatar Airways, a top-tier airline, that

can provide us with vital information in expanding our logistics

service.”

He also added, "We aim to become a search engine for the air logistics

field in which clients can check the information they need in real-time,

regardless of time and place. We thus plan to do our best to nourish our

customized services to build a stronger partnership, cherishing the meaningful

opportunity to join Qatar Airways Cargos' digital transformation."

iNOMAD is an air cargo platform, Korea-based, with a cutting-edge logistics

system created by its own software development team and air logistics experts.

They have designed the system to transmit and receive information from

logistics-related service providers and master loaders including airlines.

Being the first company connecting API(application program interface) with

airlines in Northeast Asia, the platform is operating as an online all-in-one

portal that provides air cargo booking, rates, schedule, tracking, etc.

Starting from South Korea, they have been rapidly expanding the business to

Hong Kong (established in 2022) and Vietnam (to be launched in 2024).

iNOMAD signed an MOU with Cello Square of Samsung SDS in June 2022 to build up

its customer base by presenting competitive rates. Along with this, iNOMAD is

now expecting the opening of a logistics center of 20,000 square meters in Sep

2023 as an air cargo platform terminal in the Incheon International Airport,

one of the most active airports in the world, which would be a milestone in

developing a smart logistics system. The logistics center will be equipped with

various smart devices and a security x-ray inspection system to provide safe

and advanced logistics services.

I reckon you have enjoyed reading the above useful

information.

Have a nice day.

Thanks & kind regards

ROBERT SANDS, Joint Managing Director

Jupiter

Sea & Air Services Pvt Ltd

Casa

Blanca, 3rd Floor

11, Casa

Major Road, Egmore

Chennai – 600

008. India.

GST Number

: 33AAACJ2686E1ZS.

Tel : + 91

44 2819 0171 / 3734 / 4041

Fax : + 91

44 2819 0735

Mobile : +

91 98407 85202

E-mail : robert.sands@jupiterseaair.co.in

Website : www.jupiterseaair.com

Branches

: Chennai, Bangalore, Mumbai, Coimbatore, Tirupur and Tuticorin.

Associate Offices : New Delhi, Kolkatta, Cochin & Hyderabad.

Comments

Post a Comment